A New Year is ahead of us and you might be looking for some ideas for financial New Year’s resolutions. This is the right time to assess achievements from previous year and set new targets. In this blog, we will try to inspire you with some ideas based on your financial maturity level. Let’s start!

Table of Contents

Why setting New Year's resolutions?

A bad financial status could impact your mental health. Many of us are concerned about our debts, lack of savings in case of an emergency, or simply high inflation rate diluting your wealth.

According to Bankrate’s 2023 money and mental health survey:

- Of those who worry about money, 56 percent have that worry at least once a week, and 29 percent worry daily.

- A large majority (82 percent) of those who say money negatively affects their mental health blame economic factors, including: inflation (68 percent), rising interest rates (31 percent) and not having a stable income or job (29 percent).

- Meanwhile, 56 percent say not having enough emergency savings contributed to negative mental health impacts.

- Gen Xers and millennials were most likely to say that money negatively affected their mental health of the generations — 60 percent and 55 percent said so, respectively.

Therefore, setting, tracking and achieving your financial resolutions could help improving your mental health and peace of mind.

How to select your New Year's resolutions?

It depends on your financial knowledge and objectives. We have defined 3 different levels in order to help you choosing the right resolution as per your profile. These levels depends on your financial skills, knowledge and experience.

Beginner

You do not know exactly how much you spend, how much you earn, what’s your saving rate, or have an important debt and keep the majority of your money sitting in current or savings accounts. If so, you could consider yourself as a beginner. Your main expectation for this new year is to be able to master your budget and being able to save money.

Advanced beginner

You have a pretty good idea your budget and saving rate, and have some investment experience (like a rental, or stocks). Your main expectations for this new year is to increase your saving rate and invest more.

Expert

You know exactly your budget lines and you are able to save more than 20% of your income. You have several investments and looking for ideas to beat inflation and increase your wealth.

Resolution ideas for Beginners

Track your budget

Wrap a cup of coffee and take few minutes to create a list of all the income and expenses items. If you do not want to spend hours checking every item we would recommend to take a sample of 4 months of the previous year by checking your bank(s) account statements.

We have organized our budget as follows:

INCOME | Fix | Salaries |

Rental | ||

… | ||

Variable | Bonus | |

Dividends | ||

Interests | ||

… | ||

EXPENSES | Fix | Mortgage |

Food | ||

School | ||

Insurance | ||

… | ||

Variable | Holidays | |

Eat outside | ||

Taxes | ||

Donations | ||

… |

For the variable items, what we do is to create a monthly average. For example, if we pay 12k€ in taxes during the year, then we divide that amount in 12 months which will result 1k€ per month. Doing this will allow you to know the global picture of your budget.

Then, you could use excel templates to plan your new year budget. Remember being conservative for incomes and generous for expenses. Do not underestimate your expenses. You can read more about managing your budget in our blog.

Next step will be to set your New year resolution to keep tracking your budget (at least once per quarter). We would recommend to book your agenda right away so you do not forget.

Define an emergency fund

One easy way to improve your ‘peace of mind’ will be creating an emergency fund. It consists in putting appart around 3 to 6 months of your expenses in a savings account.

This money should be used only for exceptional and unexpected emergencies such as car crash, health issues, long unemployment periods.

How to know how many months to save? Well, it depends on your individual situation. If you are young, single and with a good job, then maybe 3 months will be enough. In contrary, if you have several kids, unstable job, health issues, then maybe 6 months or more could be wise.

We use our Livret A for this purpose. It is considering its risk level (guaranteed by French government) and the interest rate. You can use as well the LDDS savings account. Check our blog about special savings accounts in France.

A final tip would be to automate your contribution to your emergency fund. Maybe you can define a monthly automatic transfer from your current account to your savings account.

Save 15% of your income

Once you are able to know your budget details (our first resolution recommendation), it could be interesting to define a goal of saving 15% of your income.

As example, if you total income is 50k€, then saving 7,5k€ for this year could be a good challenge. This amount could be allocated to feed your Special saving accounts in France and build your emergency fund.

In case you have reached your emergency fund target, you may allocate your savings to match your company’s employee saving plan contributions (PEE, PER, …)

Resolution ideas for Advanced beginners

Increase your saving rate up to 20%

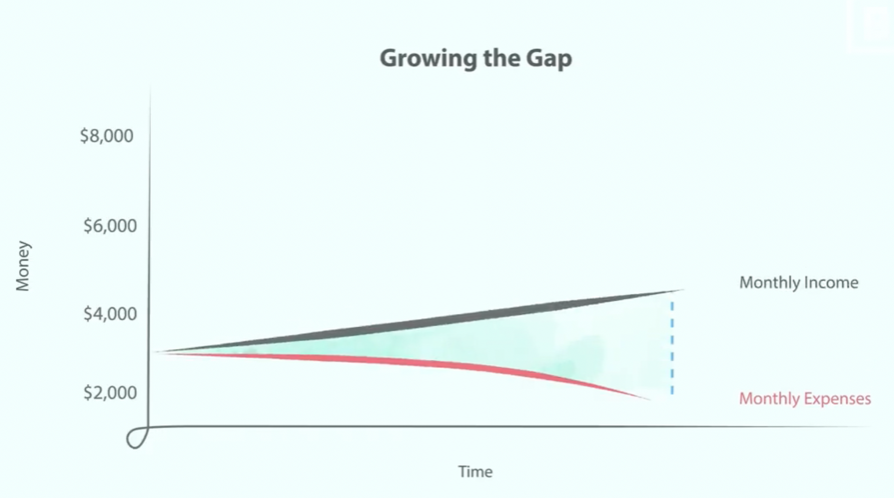

There are 3 possible ways to achieve this objective:

- Increase your income

- Decrease your expenses

- Do both

See next chart:

Achieving a 20% saving rate would be a good New Year’s resolution.

Get new sources of income

Following previous resolution, one option could be to look up for new sources of income. Even better, if it is passive income (making your money working for you) or a side hustle.

Learn how to invest in France, and explore many possibilities available to you in order to invest and increase your wealth.

Buy your own home

Buying your own home makes full sense if you are planning to occupy it for at least 8 years. You can read more about buying real estate in France.

Buying real estate is a complex and long process. There are many variables, but an important one is interest rates as it will define your borrowing capacity. You can read our blog to understand if now is a good timing to buy real estate in France.

If you have already made your mind to buy real estate, then you may want to read how to negotiate a mortgage in France.

Resolution ideas for Experts

Seek Financial independence

How would be your life if no need of a salary to cover your expenses? Would you follow your passion? Spend more time with family and friends? Volunteer to charity?

Read our blog about reaching financial independence in France to explore more this New Year’s Resolution.

Pay less taxes

Do you feel that ‘Marianne‘ is taking a lot of your revenue? Read our blog about simple ideas to pay less taxes in France to help you defining this resolution.

Diversify your portfolio

Have you had the time to analyse how is allocated your assets? Is it too much depend on a region? company? currency? sector?

We personally like to have our portfolio diversified as it contributes with our ‘peace of mind’ and help us balancing the market volatility and geopolitics changes.

Read more about How to diversify your portfolio.

Define your own resolution!

Have a deep analysis of your own personal financial status, and define a challenging but attainable objective. The important thing is to care about your personal financial health.

Our own resolution and final thoughts

We believe that money is the means to a final goal of increasing your quality of life and achieving your passions. Therefore, our main resolution for this year is to increase our % of passive income.

We track all the income coming from dividends, rentals, interests from our investments. We want to increase 50% this amount YoY (year over year) with the objective to secure our retirement and personal projects.

If you found this blog useful, please share it with friends and follow us in LinkedIn to receive more content like this. You can leave your comments below or contact us in case of any further question.

Please remember that we are not financial advisors. We are just sharing our best understanding based in our own experience. This blog is for educational purposes only. Do not make investment decisions solely based on what you read in this blog. What works for us, may not for you. Do your own research and look for professional service if required. Read our full disclaimer in the ‘about’ page.