How to manage your personal budget in France?

Creating a budget is an essential part of managing your finances in France, even though it may seem daunting at first. Whether you’re an expat or a local, knowing how to manage your personal budget in France will help you stay on top of your expenses and make sure you’re not overspending. By following these tips, you’ll be able to create a budget that works for you and helps you achieve your financial goals.

Table of Contents

Managing a personal budget - step by step

Calculate your income

The first step in creating a budget is to determine your income. Add up all the money you earn each month from your job, investments, or any other sources. Note: do not forget taxes and other charges! Your employer will announce salary and bonuses in gross amounts, but surprise surprise! your net amount could be easily -35%! So do not forget to take this into account when budgeting.

List your expenses

Next, make a list of all your monthly expenses. This includes things like rent, utilities, groceries, transportation, entertainment, and any other bills you have. Do not forget variable expenses (those that happens once in a while), like the ‘tax foncière’ (if you own a property), holidays, etc.

Categorize your expenses

Once you have a list of your expenses, categorize them into fixed and variable expenses. Fixed expenses are those that stay the same each month, like rent or a car payment. Variable expenses are those that can fluctuate from month to month, like groceries or entertainment. It could be a good idea to add another categorization to understand what are real ‘needs’ and ‘optional’ expenses (like eating out, movies…). Try to stick to the 50-30-20 rule: 50% needs, 30% optional expenses, 20% savings.

Set your goals

Decide what your financial goals are. Do you want to save for a down payment on a house, pay off debt, or go on a vacation? Knowing your goals will help you prioritize your spending and make sure you’re putting your money where it matters most.

Pay yourself first

It means that once you receive your paycheck, the first thing to do will be to transfer the money to your investment accounts. It will remove the temptation to use that money for impulsive expenses. There will be always a good excuse NOT to invest … I need that new iPhone 😉

Determine your spending limits

Based on your income, expenses, and financial goals, set limits for how much you can spend in each category. This will help you stay on track and avoid overspending.

Track your spending

Once you have your budget in place, it’s important to track your spending to make sure you’re sticking to your limits. You can use a spreadsheet, an app, or even a pen and paper to keep track of your expenses. Another trick will be to have multiple accounts / debit cards: one for MUST expenses (electricity, loan, …), and another one for OPTIONAL expenses (eating out, cloths, drinks, gadgets, etc).

Adjust as needed

Your budget is not set in stone. If you find that you’re consistently overspending in one category, you may need to adjust your spending limits or find ways to reduce your expenses. A monthly review would be ideal. If too busy, then at least a Quarterly review. Book it in your agenda, otherwise you will forget about it.

Why is important to have an emergency fund?

An emergency fund are savings that you should use it (break the glass) ONLY when a major unexpected event happens (like losing your job, illness, divorce, lawsuit, death of a relative, etc). We know this kind of events could be already hard to go through, and you do not want to make it harder because of lack of money. Creating this fund will allow you sleep well at night and give you the freedom to allocate your remaining savings in more fruitful (and probably riskier) investments (such stocks, real estate, etc.).

Emergency fund golden rules

These are our ‘golden rules’ when it comes to manage an emergency fund:

- The amount of an emergency fund should be minimum 3 and maximum 6 months of your expenses. Having less than 3 months could be too low and not enough to cover a major event. Having more than 6 months could be too much and you will be missing other attractive investment opportunities.

- It should be in savings or checking accounts (high liquidity and availability). You should not consider as ’emergency fund’ locked investments like the PEE, or real estate, or any other investment product where you cannot have your money in matter of hours, or if even if available, it may not has reached its maturity level. A good example will be stocks. Yes, you can sell it online, but considering its volatility, you may be forced to sell low. Imagine you lose your job due to an economic crisis. The stocks will be low, and you could be forced to sell losing. Not ideal!

- Emergency funds must not be used for other purposes. A trick to avoid being tempted to use that money incorrectly, could be to write down in advance the valid emergency events.

- You should reach your emergency fund target amount BEFORE doing any investment. First things first!

myFrenchMoney tip

You can negotiate with your bank to get a kind of credit related to your debit card (carte bleu) which is called 'decouvert'. Meaning that it will allow you to get in negative balance. You can negotiate the interest rate and the max. amount.

By doing this, you can minimize your 'emergency fund' and free up cash to invest the most possible.

What tool to manage my budget in France?

We use excel template (files / new template / personal budget), or ‘Numbers’ for iOS users. It is simple, free, flexible.

Some banks propose online budget management features. However, if you have multiple accounts (with your couple, childrens) it could be a limitation. To overcome this problem, there are some cool apps that will help you saving time by aggregating your bank accounts, receiving notifications when over spending, charts, analytics, etc. You may need to subscribe or use the free version. The downside of these apps is about cybersecurity. Normally, they use certified 3rd party tools to manage your bank account passwords but there is always a risk. Up to you to do the analysis and make your own decision. In case you want to give it a try, here a list with with apps:

We have used the premium version of Bankin’ in the past and we recommend it. It is very simple to use, fast, user friendly, and with the premium version you can customize categories, and more cool features.

Managing a budget in excel

As many, we do have an excel file where we manage:

- A ‘classic’ or standard month income (money in)/ expenses (money out). Some items are fixed (ex: loan) and some others variable (ex.: vacation). For the variable ones, we sum up all the amount of the year and then divide it by 12 months (to get a monthly average). This budget exercise will help you understand what a ‘normal’ month looks like and more importantly, to define if you are positive or negative (Income – expenses). Are you living over your means? If so, you need to make some changes / adjustments.

- Cash flow: Additionally, we estimate the next 12 months Income and Expenses. This time we will not make any monthly average, but we will include absolute figures, the most as possible close to reality. As example; we will include for the month of August the amount corresponding to vacations. However, you may book the hotel in advance (say in February). Then you should put that expense in February (money out). Same for Income: You may want to include the special bonus early in the year (money in). Here is the key point: The monthly balance must be always above the ’emergency fund’ level. By doing this exercise you will be able to visualize the future, and how you can distribute your expenses across the year in order to avoid lack of cash and recurring to unnecessary debt.

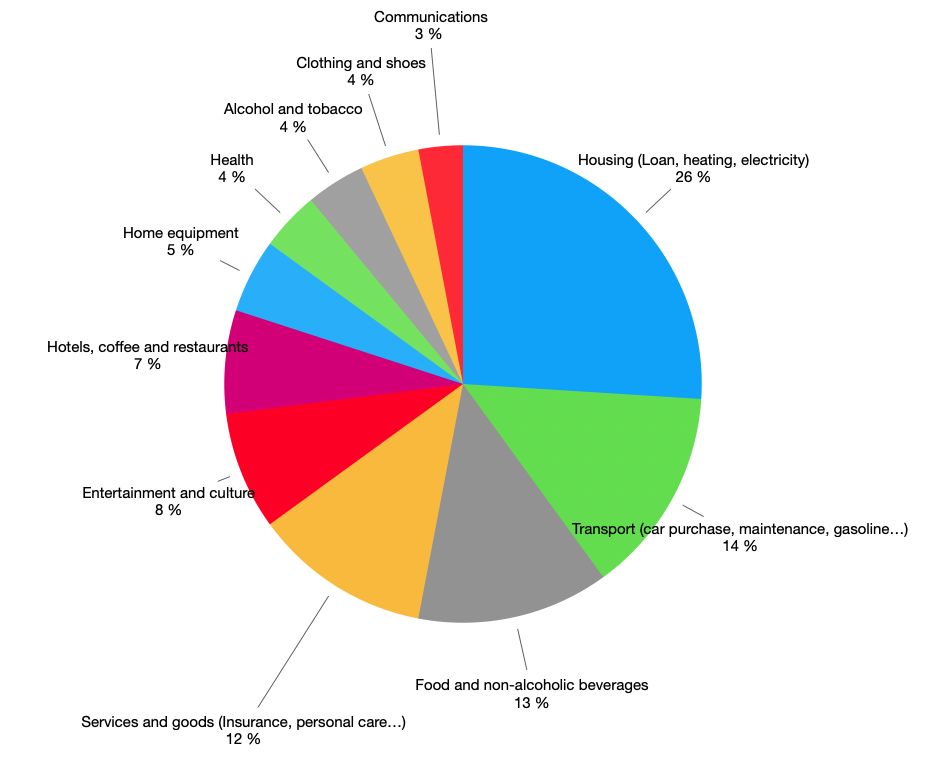

How people spend their money in France?

According to the INSEE (The National Institute of Statistics and Economic Studies) this is how a people in France are spending their money (year 2018):

Some other interesting facts. Each french (average) :

- Has 3 monthly subscriptions (like Netflix, etc)

- Pay 20€ per month on bank fees

- Pay 40€ per month for mobile subscription

How to save money without sacrificing your lifestyle?

We recommend you to read our blog about ‘How can I save money in France‘, however, we can give you some few tips that you can apply immediately without sacrificing your lifestyle:

- Negotiate your bank fees. 20€ per month makes 240€ a year. There are some online banks with ZERO fee or very low. We recommend Revolut. Besides low fees, you can transfer money abroad with interesting rates, great customer experience, cashback, and you can even buy stock, crypto.

- Save international transfer fees. Normally regular banks will charge you high fees and apply not convenient rates when wiring money abroad. We use either Revolut or Wise for international transfers. By doing so, you can save overtime an important amount of money.

- Group your credits. If you have one or several mortgages, personal credits (crédit a la consommation), car credit, etc… you can call a ‘Courtier’ (broker) who will help you grouping all those credits into a single one. Besides the simplicity, you can extend the payment duration and reduce the amount you have to pay monthly. It will give you extra bandwidth. Up to you to use it wisely and invest that money instead of spending it.

- Negotiate your loan assurance. Since a couple of years ago, French government simplified the process for individuals to renegotiate the loans assurance. You can call a broker or do it by yourself online. Saving few dozen euros per month, will be thousands over years.

- Negotiate your cable / internet box. You can call any competitor of your actual company (Free, Bouygues, Orange…) and ask for a better offer.

- Check your subscriptions. Many of us will have unused or useless subscriptions. It may seem low amounts, but recurrent monthly expenses adds up quickly. international

Creating the habit to manage your budget

Managing your budget is the basic step on personal finance. It is the key to unlock your financial wellbeing and even your retirement plan. We all have different backgrounds driving our relationship with money. It is all about emotions and habits. There are some good books to help you managing your emotions and control over spending (if this is a problem for you). Managing a budget is an skill that you will need to practice and become better over time.

In addition, you should review your budget regularly in order to make the required adjustment and avoid further damage down the road and secure your investment objectives. If you are not use to do it regularly, book your agenda end of each month to create the habit. You will see that after the few months tracking your budget, it will become natural to do it. Your ‘future you’ will thank you for acquiring this habit.

Last words

If you found this blog useful, please share it with friends and follow us in LinkedIn to receive more content like this. You can leave your comments below or contact us in case of any further question.

Bon chance!

Disclaimer

Please remember that we are not financial advisors. We are just sharing our best understanding based in our own experience. This blog is for educational purposes only. Do not make investment decisions solely based on what you read in this blog. What works for us, may not for you. Do your own research and look for professional service if required. Read our full disclaimer in the ‘about’ page.