Table of Contents

As an expat living in France, you may be interested in investing your money by taking advantage of the local opportunities. However, it might be cumbersome and time consuming to get familiar with the details and you may want to avoid making costly mistakes.

We will be sharing in this blog our investing experience as foreigners living in France.

Investing opportunities in France

-

Invest in real estate: this is the main asset owned by french families. You can buy your own home, invest for renting, through SPCI (Société Civile de Placement Immobilier) – or REITs -, and finally some more innovative ways such as crowdfunding.

-

Invest in the stock market: One way to invest in France is by buying stocks of French or European companies. You can do select a broker account and open a PEA (tax-efficient wrapper).

-

Invest in a mutual funds: Mutual funds are a popular investment option in France, and there are many different types of funds available. You can invest in a French mutual fund through a French bank or brokerage firm. However, you may want to pay attention to its fees (some up to 3%). An smart way could be to use this investment type only for Small caps, or specific themes like ‘AI’, ‘ESG’…

-

Invest in a government bonds: French and European government bonds, also known as OATs, are a low-risk investment option that can provide steady income. You can buy OATs directly through a French bank or brokerage firm. Most french will invest through an AV (Assurance Vie).

-

Invest in startups: France has a vibrant startup scene, and investing in a promising startup can provide high returns. You can invest in a startup through a crowdfunding platform or through a venture capital firm.

Investing in real estate in France

France offers to you multiple options to invest in Real estate. Either because you are looking for a new home, or because you want to invest in a rental property.

Real estate investments is very popular in France. French are very attached to this kind of investment as it is tangible. This means that you will have a lot of local competition.

Notice that prices are very expensive in Paris and its suburbs (around 10k€ per m2). You can check real estate prices in this web site.

It is common to request a real estate agency support to search the property that you are looking for. They normally charge around 6% fee (negotiable) but will do all the search and even negotiate the price on your behalf.

It is important to demonstrate that you have your requirements clear (location, number of bedrooms, floor number, etc) and that you have your bank agreement. Else, they may not give you priority when they find a good deal.

There is a formal process to follow when buying a property in France. You will need to sign a ‘compromis de vente’ which is a preliminary sales agreement.

Both the buyer and seller must sign the ‘compromis de vente’, which outlines the terms and conditions of the sale, the purchase price, and any conditions or contingencies. At this stage, you will typically pay a deposit of around 5% to 10% of the purchase price.

You will bear the ‘notary’ administrative fees, which can be up to 7% as they will do all background checks and serve as 3rd trust party between you and the vendor.

There some other innovative ways to invest in real estate in France. We invite you to read our blog on investing through a SCPI and Crowdfunding.

Finally, If you make your mind and decide request a bank loan, check out our blog on How to negotiate a mortgage in France.

Investing in the stock market

After Brexit, Paris stock market (Euronext) has gained a new place in the world of trading. It offers interesting investment opportunities with domestic and european companies. The CAC40 index contains the top 40 companies, such as LVMH (Louis Vuitton), TotalEnergies, L’Oréal, Axa, AirBus, Air Liquide, Schneider Electric, etc. (not an investment advice).

It is important to understand that European market is usually more stable than others (like US, China, India…). As a consequence, you will find well established companies, growing steady but constantly.

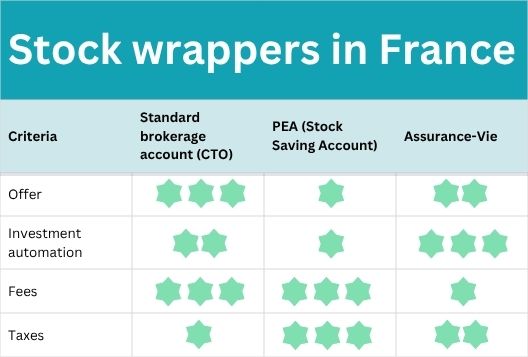

European market is interesting for high yield dividend companies. In France, you have the opportunity to invest through tax-exempted investment envelops such as the PEA (Plan d’epargne Actions) and the AV (Assurance Vie). They both have constraints and limitations that you should understand before investing. Of course, you can invest as well through an Standard brokerage account.

Here a comparative table for you to understand the differences among them:

Investing in startups

If you are looking for high return investments and you have good risk tolerance, you may look to invest in french Startups. Here some of the most successful ones:

-

BlaBlaCar: A ridesharing service that connects drivers traveling between cities with passengers looking to travel the same route.

-

OVHcloud: A cloud computing company that provides managed hosting services, virtual private servers, and dedicated servers.

-

Doctolib: A healthcare appointment scheduling platform that connects patients with doctors and healthcare professionals.

-

Front App: A collaborative inbox for teams that helps them manage emails, messages, and social media accounts.

-

Mirakl: A B2B marketplace platform that enables businesses to launch and operate their own online marketplaces.

-

Wemanity: A consulting and training company that helps organizations adopt agile methodologies and improve their digital transformation.

-

Meero: An online marketplace for photographers that connects them with businesses and individuals looking to purchase their services.

-

Ynsect: A sustainable agriculture company that produces insect-based ingredients for the food industry.

We have invested in a handful number of startups mainly through the platform Wiseed and directly with some others. It is very important to bear in mind that investing in startups is very risky. A very high % of startups fails and you can lose all your capital.

Finally, bear in mind that to start seeing some benefits, you would need to wait min. 5 years. So your money will be blocked / unavailable during all those years. In few words, you should not invest the money you will need in the next years. In the other hand, if it works, you may get 10X returns or more.

Conclusions

As you can see, there are many investing opportunities in France that you can take advantage to see your money grow. Being expat or a foreigner in France does not mean to put on hold your personal finance plans.

Before you start investing in France, it’s important to do your research and understand the risks involved. Consider consulting with a financial advisor who can help you create a diversified investment portfolio that aligns with your financial goals and risk tolerance.

If you found this blog useful, please share it with friends and follow us in LinkedIn to receive more content like this. You can leave your comments below or contact us in case of any further question.

Bon chance!

Disclaimer

Please remember that we are not financial advisors. We are just sharing our best understanding based in our own experience. This blog is for educational purposes only. Do not make investment decisions solely based on what you read in this blog. What works for us, may not for you. Do your own research and look for professional service if required. Read our full disclaimer in the ‘about’ page.