Table of Contents

We like SCPI in France as it is a practical way to invest in real estate with very low effort, and limited risk. It is a good fit for people looking for additional and steady passive income in the long term. However, it is full of taxes and fees. Your capital is at risk as well. Let’s get into more details.

What is SCPI in France?

SCPI stands for ‘Société Civil de Placement Immobilière’ (known as well as ‘Pierre Papier’) which is a private investment company with the unique purpose of buying and managing real estate (similar to REITs ‘Real Estate Investment Trusts’) on behalf of its shareholders . They are not listed in the stock market and can own only properties. Typically they invest in commercial, industrial, and offices.

SCPIs are managed by a professional management team who collect the funds invested and undertake the acquisition, construction and management of the properties. Of course, they get paid for that!

Notice SCPI is different from SCI ‘Société Civile Immobilière’. The latter is merely a limited company that can be used for the purchase and ownership of French property.

How do SCPIs make money?

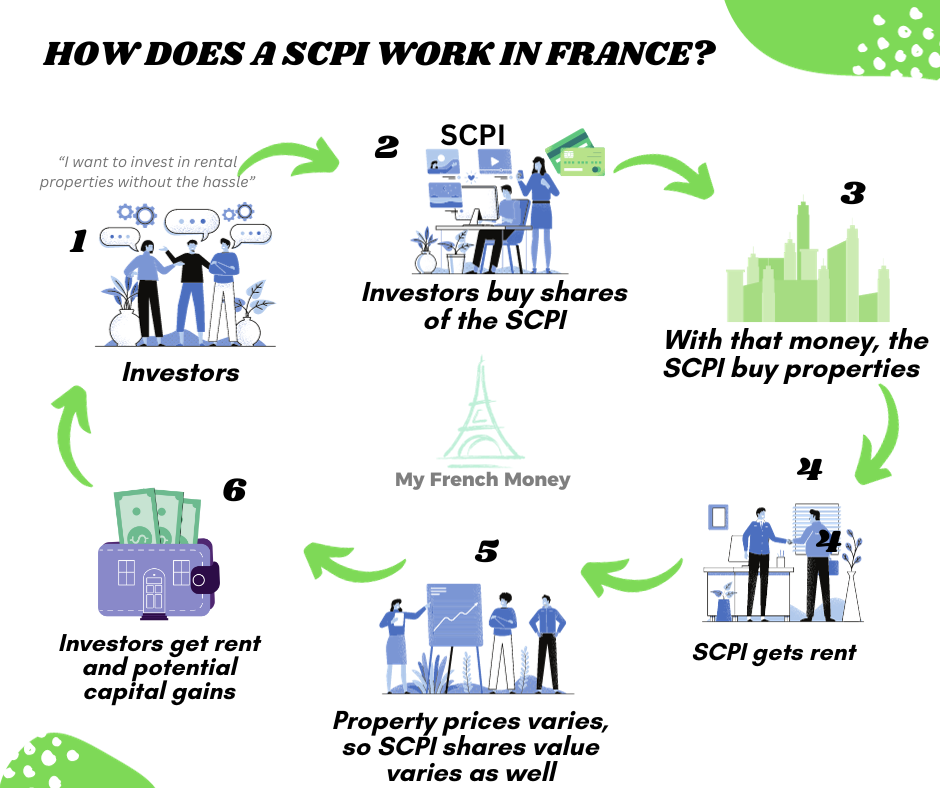

It follows the same logic as any other real estate rental. SCPIs are buying properties with your money. Then renting this property to tenants. SCPI income comes from the rents that are charged to tenants, which is then paid out to shareholders in dividends, normally on a quarterly basis, pro-rate to the number of shares held.

In addition, the real estate property owned by the SCPI can increase value over time. Every year, an independent evaluation will be carried out to determine the estimated market value of the SCPI properties. Consequently, your shares could increase (or decrease) value.

Finally, if a property is sold and generates capital gains, then it could be as well distributed to SCPI shareholders as an extraordinary dividend.

What are the benefits and constraints of a SCPI?

Benefits:

- Good return rate (average around 4%)

- Effortless and passive income

- Good income visibility – low volatility

- Shared risk, as you will own multiple properties

- Regular payments (monthly or quarterly)

Constraints:

- High taxes and fees

- Long term investment (+5 years)

- Risk of part devaluation

- Capital non-liquid

Our tips to get the most from a SCPI in France

Invest in an european SCPI

In order to reduce taxes, it could be wise to invest in an European SCPI, as it will be taxed in the country of origin (ex: Germany) and it could represent a substantial saving compared to France... plus the diversification. However, tax return declaration becomes a little more complex.

Invest in a young SCPI

Investing in a newly opened SCPI could be a good idea, as they will invest the collected capital acquiring new properties. If they do their job right and select good ones, those properties could increase value over time (and your part's valuation as well). Today's constraints and opportunities are different (remote work, environmental requirements, etc.) and new SCPI can take advantage of that (compared to old one's that already have properties).

Invest in SCPI 'démembrée'

If you do not need the dividends right away and could wait for 5 years or more, you could buy a SCPI 'démembrée' or 'nue-propriété', which means that you will get an interesting discount on the share price but in the other hand you will give up the dividends during a given period of time. The longer, the higher the discount. For example, for a 10 year holding period, you could get up to 35% discount on the SCPI part. In addition, you do not own any taxes during this period.

Invest in SCPI with a bank loan

If you still have some credit capacity (less than 1/3 of your income), then you could request a credit to your bank to buy SCPI. It could be a good financial idea as long as the real estate interest rate (ex.: 3% with insurance included) is lower than SCPI net return (ex.: 4%). Then, the delta (1%) could be a nice leverage for you. Of course, past returns do not represent future returns. It is still a risk you will need to evaluate.

Last tip would be to include the SCPI within your ‘Assurance Vie‘ in order to profit from the benefits from tax exemptions of this investment wrapper

Risks of SCPI in France

Capital invested in a SCPI is not guaranteed. This means that you can basically lose all your money in case the SCPI goes broken. Probabilities of happening are very low (compared to other investment types like startups, stocks for example).

Even if it happens, you could recover a part of your capital as there are buildings and real estate backing up your investments.

Dividends are not guaranteed either. It means that your return could vary from one year to another.

However, the major risk (most probability to happen) is about share devaluation. By law, SCPI companies need to perform an independent asset valuation. If it drops, your shares will do the same. SCPI valuation is strongly correlated to interest rates and real estate market value.

How to choose a SCPI in France?

Here some points to consider when evaluating a SCPI

- Returns history. Even though good past returns does not necessarily mean good future returns, you have better probabilities to get similar ones as it is quite stable.

- Potential part revaluation. As the previous point, it is important to look at the SPCI historic revaluations and compare it against inflation rate. It is important to understand any future potential revaluation as well (ex: Better exchange rate for properties ex-Euro, emergence of a specific real estate sector like Data Centers, etc.)

- Fees. Most of the SCPI entry fees are around 8 to 12%. Then you have annual maintenance fees around 10% of total rents.

- Diversification. Unless you have a sector preference (ex.: Health) you may want to choose a well diversified one (Office, Health, Commerce, Hotels, Residential…). Some SCPI have managed to go well through COVID crisis thanks to this diversification.

- Debt rate. High interest rate environment could put stress on some SCPI.

- Flexibility to allow you to invest through an ‘Assurance Vie’ and/or with credit.

- Total valuation and years in the market.

- Cash reserves (‘report a nouveau’). It is internal savings to face potential income issues or to profit from market opportunities to acquire new properties.

What are the best SCPIs to invest in France?

Here a short list of some well known SCPIs in France:

- Corum (more than 10 years returning 6-7%) – diversified. This is our preferred one as we like the value strategy and its diversification. They invest wherever the opportunities are. For instance, they bought some properties in the UK after BREXIT (Corum XL) and took advantage of discounted prices in London. They sell as well when good conditions are present which leads to interesting exceptional dividends payout. You can use our referral code: OWQV68 to get up to 3% fee discount (check conditions in their web site).

- Altixia Commerces (5,3% dividend 2023) – specialized in Commercial buildings.

- Pierval Santé (5,3% dividend 2022) – Health

- Iroko Zen (7% dividend 2023)

- Remake live (7,7% dividend 2023)

Important note: This is not financial advice. Do your own research. You can lose capital invested. Past returns do not imply future returns.

Our experience with SCPI in France

We have included SCPI back in 2019 as part of our investment portfolio as it is a good protection against inflation and a stable passive source of income. However, we made the mistake of investing outside our ‘Assurance Vie’ and we missed its tax benefits. Another thing we missed was the ‘demembrée’ option.

We have allocated only a small % of our portfolio as we could not get a bank credit to invest in our preferred SCPI (Corum – Origin and Eurion). Nevertheless, we enjoy the passive monthly dividend that we are receiving and we reinvest it automatically to create the snowball effect in a few years time.

Last words

If you found this blog useful, please share it with friends and follow us in LinkedIn to receive more free and useful content like this. You can leave your comments below or contact us in case of any further questions.

Discover the ultimate guide to managing your money in France with our “Expat’s guidebook for personal finance in France” and unlock the secrets to thriving financially while living in France.

Bon chance!

Disclaimer

Please remember that we are not financial advisors. We are just sharing our best understanding based on our own experience. This blog is for educational purposes only. Do not make investment decisions solely based on what you read in this blog. What works for us, may not for you. Do your own research and look for professional service if required. Read our full disclaimer in the ‘about’ page.