How to invest when living in France? What are the investment options available for you? How to start? You may feel overwhelmed and scared about making wrong decisions, as the finance world like too complicated.

In reality, you just need to understand some basic concepts. We will be sharing a summary of what we hear from experts, read in books, and our own experience on how to invest while living in France.

Let’s jump right into the subject…

Table of Contents

Why investing is important?

Investing is the only way to make your capital growth, even though it comes with some risks. If you do not invest and keep you money under the bed, you are simply losing purchasing power due to the inflation. 100€ today will not allow you to buy the same goods and services in the future.

In addition, you may want to prepare your retirement or an specific future project (like marriage, dream trip around the world, buying a home, etc.). Smart investing will help you reaching your objectives thanks to the compounding effect (reinvesting your interests, capital gains or dividends).

Investing vs Speculating vs Trading

Investing is normally mid / long term. When you buy assets for investing, you consider the market value and its level of risk. While speculating and trading is for short term gains, but with high risk.

We all want to get rich by tomorrow, but unfortunately the probabilities of losing are much way higher than winning when you speculate. In contrary, if you invest smart, and give the necessary time to mature, you have high chances of creating wealth.

Some examples of speculating are buying an stock because of rumor, or simply because everybody else is doing it. Trading could be profitable, but you will need to become a professional and invest thousands of euros in specialized equipment and services.

We have made the mistake in the past trying to speculate and we paid the price. It was during Covid pandemy when millions of bored people sitting in the couch, started to speculate with stocks that were about to bankrupt. It made the stocks go high, but next days it drops all gains and we end up losing money. You can hear similar stories with cryptos and other volatile investments.

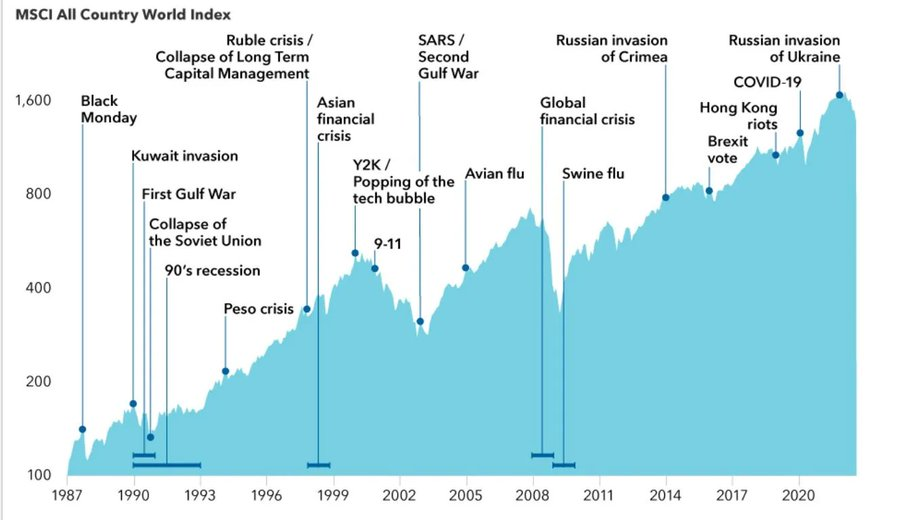

Investing in the long term increases your chances of growing your capital. In the next chart you can see the major crisis during last decades and its impact on the stock market. Those crisis that seem at the time like the end of world are just small dips when zooming out:

Risk / Reward ratio

It is important to understand the correlation between risk and reward of your investment. If anyone is proposing you a high return investment with no risk of capital lost, most likely it is a scam.

Here a figure to represent the correlation between both variables:

You should always strive to minimize the risk for each investment. For example: If you want to invest in real estate, you may want to select the right tenant to avoid unpayments. When it comes to stock market, you could invest in an ETF or mutual fund to avoid investing in only one company.

Another trick would be to buy an asset cheaper than its fair value, in such a way to minimize your risk of losing money. If you want to understand more about this correlation or have some more ideas on how to minimize risk, we will be happy to exchange with you.

Criteria to choose the right investment asset while living in France

Return of Investment rate - RoI

It is the % you earn or lose when you make an investment. You get it by dividing the net profit earned on an investment by the cost of that investment.

As example, if you invest 100€ and 1 year later your investment is worth 115€, and taxes are 5€, then your net profit would be 10€. Your RoI would be then 10%.

Risk

It is simply the probability to lose or gain money. You can quickly lose or make a lot of money with certain investments. It is the famous return / risk couple.

The higher the risk, higher the potential return. You will need to assess your risk tolerance before deciding to invest. If low, you may not want to invest in high risk assets like cryptos, stocks, etc.

Having low risk tolerance means as example not being able to sleep at night if you are losing 60% of your investment, or rushing and selling when markets are at the very low.

Notice that is not the same ‘saying’ that you can tolerate risk, than ‘living it’. Looking back to the most recent COVID crisis, it required lot of strength not to sell our stocks at -40% when we lock downs started around the world and jumping to the unknown.

myFrenchMoney tip

People normally sell their assets at the bottom because of the need to act when things are doing bad. Hence, our advice will be write down in advance your plan in case market crashes and to keep a cash reserve to buy cheap assets. That should help you navigating through difficult moments.

Taxes

Some investment assets are highly taxed, and some others the government want to encourage citizens to invest and therefore they provide tax benefits.

For instance in France, real estate investments are normally highly taxed compared to stocks or even crypto (flat tax).

We believe that tax optimization should be a secondary criteria when deciding on what to invest. First objective of investing should be to earn money, and not to pay less taxes. If by doing so, you can save some taxes, then great.

You can learn more by reading our article about Income tax in France and Social contribution Tax.

Fees

It represents the administratives charges by the providers of the investment product. Sometimes, it could be tricky and difficult to spot them.

As example, annual fees when investing in a ETF are around 0,2% to 0,6%. The ‘Assurance vie‘ products proposed by your bank are most of the time are from 1% up to 3%. The impact in long term could be up to 50% of the gains. Would you agree to give to your bank such a big part of your earnings?

Here an illustration of the huge impact of high fees on your earnings (credits: Forrest Financial Partners)

Effort

It is the level of effort and time spent from your side, either to select the investment asset and/ or to manage it over time.

As example, if you want to invest renting an apartment, it will consume an important number of hours just to find the right property. Without mentioning the time to get the mortgage approved, refurbishment works (if any), finding a tenant, repairing water leaks during weekends, etc.

Whereas investing in the stock market, you can do it just after few seconds sitting in your couch from your mobile phone. Of course, you will need to do your due diligence and select the right value to invest in.

Liquidity / Availability

It is about the capital availability while invested. For the same apartment example, it could take months to sell it and get your invested capital back. You cannot pay a baguette at the bakery with a piece of your apartment right?

Typically you should not be investing the money that you will need in the short term. Else, you may be forced to sell your asset when market conditions are not favorable and your investment is not mature enough.

There are some other criteria to consider, like your age, specific personal convictions (ESG criteria for example), the amount to invest, etc. This is the main role of a financial advisor. We could recommend english speaker advisors if you contact us.

Summary table

Here a comparative table with the most popular investment assets available in the market. Our objective is to help you having an overall idea (not as an investment advice) on each asset characteristics:

Investment products characteristics

| Investment product | Return | Risk | Taxation | Fees | Effort | Availability |

|---|---|---|---|---|---|---|

| Saving account – Standard | Low | Low | Low | Low | Low | High |

| Certificate of Deposit | Low | Low | Low | Low | Low | High |

| Deposit account | None | Low | Low | Low | Low | High |

| Saving account – Livret A | Low | None | None | None | Low | High |

| Saving account – LDDS | Low | None | Low | None | Low | High |

| Saving account – PEL | Low | None | Low | None | Low | Medium |

| Stock – individual | High | High | Medium | Low | High | High |

| ETF | High | Medium | Medium | Low | Low | High |

| Mutual funds | High | Medium | Medium | Medium | Medium | Medium |

| Gold/Silver | Medium | Low | Medium | Medium | Low | High |

| Bonds | Low | Low | Medium | Low | Low | Low |

| Real estate – rent | Medium | Medium | High | High | High | Low |

| Real estate – SPCI | Medium | Low | High | High | Medium | Low |

| Private debt | Medium | High | Medium | Low | Medium | Low |

| Private equity | High | High | Medium | Low | High | Low |

| Cryptos | High | High | Medium | None | Medium | High |

Investing without (or little) money

Yes, it is possible. The most classic example is when you invest in real estate. You can get a loan from the bank to buy a property. Of course, you will be paying a mortgage but you could get benefit from the lever effect.

Imagine you got 100 000 € loan from the bank to buy an apartment for rent. 5 years later, the same apartment value has increased up to 110 000€. You have earned 10 000€ with the bank’s money. Of course, the real calculation is a bit more complicated than this, but it is just to explain the idea.

myFrenchMoney tip!

You may buy stock fractions with only few euros. The broker Revolut allows you to buy a little piece of a stock with the money you have available. Hence, you can buy 10$ of Apple, even if the 1 stock value is much more than that. Click on the start above to register with our referral offer if you decide to open an account with them.

Sequence of investing

Now that you understand the investment criteria, types and its characteristics, you may be wondering where to start? If we would have to start over again, this is the way we would do:

Secure solid foundations

Before investing, it is important that you have cleared all ‘bad debt’ and build your ‘emergency fund‘.

Bad debt means credit cards and / or ‘crédit à la consommation’. Differently from ‘good debt’, like house mortgage or any other capital allocated for investments that will increase your wealth over time. As a matter of fact, paying all bad debt will free you up from high interest rate loans and increase your saving rate.

The emergency fund is an equivalent amount of 3 to 6 months of expenses dedicated to cover any unexpected major issue in your life (like losing your job, an accident, divorce, etc.). The importance of having an emergency fund is to give you ‘peace of mind’ and preventing selling other assets when needing liquidity. The special savings accounts (Livret A, LDDS, PEL…) in France are ideal for this purpose.

Real estate

Once these 2 previous points are secured, you may start looking for a real estate investment. We like its ‘lever effect’ in the long term and limited risk – as explained in our previous section of ‘investing with little money’. In addition, paying the mortgage every month is a kind of ‘forced saving’ that could be a good fit for those not able to stick to a budget.

Stocks

Next, we would be looking for a bit more risky and profitable investment like stocks. It could be a good idea to starting investing regularly (DCA : Dollar cost average) in a World ETF. Stock picking could be a good fit for those interested in the stock market and looking to spice up their portfolio.

Exotic investments for the last

Finally, after you are debt free + a solid emergency fund + a real estate property + stock investments… then, and only then, it could be wise to start building some other pockets like:

- Gold: Decorrelated from stock market and euro. Maybe around 5% of our total portfolio;

- Crowdlending / crowdfunding : To secure an interesting return baseline of 10%;

- Cryptos and / or Startups for the most braves! Very high potential returns and volatility. We would allocate less 5% in this pocket.

Read our blog about how to diversify your portfolio to learn more.

Our experience investing in France

We prefer to invest mainly in assets that add value to people by providing products or services.

Investing in a company that makes sustainable profit by selling a product and fulfilling a market need, will have higher chances to share that profit with you compared to an speculative crypto coin with a dog face (even though we like cryptos with a real-life application). Besides the fact that you will make sense of your money and contribute to the ‘real economy’.

Our portfolio is mainly invested in stocks (ETFs, diversified stock values, PEE), followed by real estate (rental, SCPI), Crowdfunding, crypto (Bitcoin and Ethereum), gold, savings accounts (Livret A).

Final thoughts

An important point to highlight will be about considering diversifying your portfolio of assets as an additional way to minimize the risk. For instance, normally when there is a huge economic crisis stocks will crash but gold could go up. It could compensate what you are losing in one pocket with the other.

If you found this blog useful, please share it with friends and follow us in LinkedIn to receive more content like this. You can leave your comments below or contact us in case of any further question.

Bon chance! et Bon investissement!

Disclaimer

Please remember that we are neither financial nor tax advisors. We are just sharing our best understanding based in our own experience. This blog is for educational purposes only. Do not make investment decisions solely based on what you read in this blog. What works for us, may not for you. Do your own research and look for professional service if required. Read our full disclaimer in the ‘about’ page.

This blog is such a life-saver when it comes to being an immigrant/expat in France and trying to create financial freedom. The blog is very informative, well-structured and interesting especially for beginners. I can only recommend it for people who are interested in investing and financial freedom.

Thanks Luiza. Happy you found it useful.